Cash Flow Projection For Your Business Cash Flow Prediction

You are having issues with your business’ cash flows. You are still trying your best to hang in there, to keep your business surviving. But signs have not been positive – sales are decreasing, on some days you couldn’t even afford to operate your business. The voices in your head are telling you to just give up and cease operations, but that is the last thing you ever want to do. You start calculating your available cash and estimate how long more your business could last. One month? Three months? You suddenly vividly remember reading an online article that as a healthy business, you need to have at least one year’s worth of cash flows to be able to cover all the expenses without any income. However your estimation is much lesser than that. Oh no. You are doomed.

Everything consumes cash. When you want to start up a business, you need to inject cash. You need people to work for you, you need cash to pay them. To have a better control over your cash in your business, you need to have proper planning. You need to plan how much inventory you need and how much it would cost, how many people to hire and how much would you need to pay them on a monthly basis, or even how much you should spend to expand your business. You need to set a limit to your expenses and always be alert of how much cash there is in your bank account, and determine the portion you could utilise for investments. You don’t want to end up purchasing something but ended up not being able to pay off the debts.

In reality, how many bosses actually fully take note of where their money goes? Do you hear your people complaining about having insufficient cash to get a job done? If this happened to you before, what did you do? Did you put in effort to trace back all the expenses to determine where the cash has been excessively spent or you just shove it off? This is why you need a cash flow projection. It helps you track expenses not only in the past, present, but also in the future. Familiar with the saying “no money, no talk”? If you have no money due to no proper planning and no clear view of your cash flows, then there is no way you could make your business grow.

Kenny owns a big workshop which mainly repairs luxury vehicles. Kenny does not have a complicated accounting system to observe the company’s income and expenses. He usually just relies on a simple report produced by his accounts clerk on a monthly basis. From this report, Kenny would predict the following month’s expenses.

However, a nationwide economy crisis happened out of the blue. Kenny panicked because he observed his business’ sales dropping drastically. Expenses were significantly higher than income and Kenny still had debts from suppliers to settle. Kenny knew he needed to take a loan but the problem was, he did not know how much. With the available cash Kenny has, he wants to know how long he could survive and therefore asked his accounts clerk to provide him an estimation. Too bad, his accounts clerk could not help him make decisions at all. The information they had was insufficient to make any estimations on survival. Kenny had to act quick and therefore sourced for help. He approached a CFO for immediate solutions to his problem. The CFO taught Kenny to plot a cash flow projection.

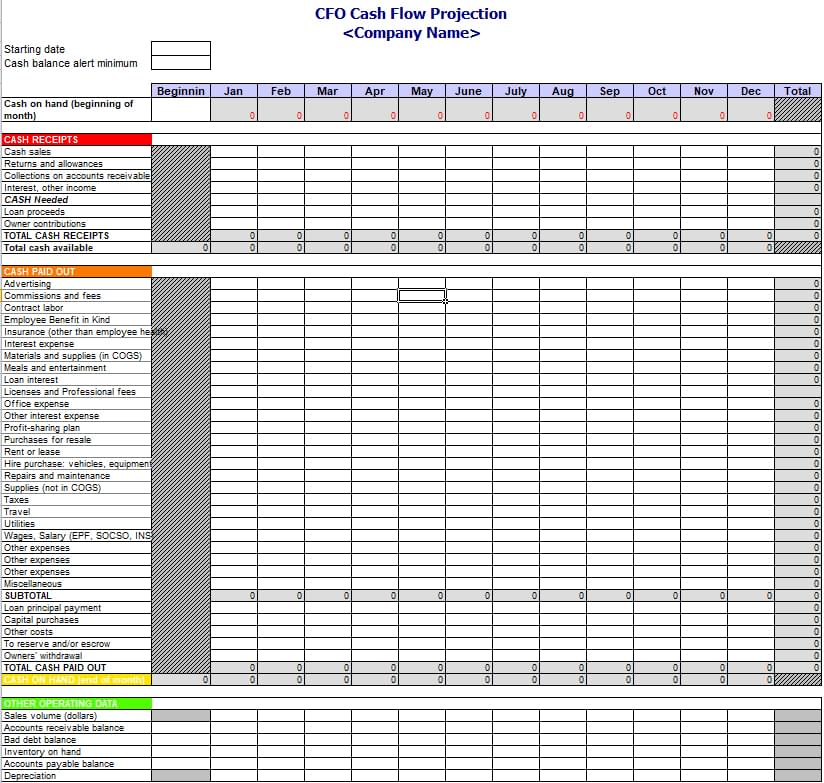

Cash Flow Projection

In general accounting knowledge, a cash flow statement shows the inflow and outflow of money of your business. You need a healthy cash flow to keep your business surviving. Conversely, negative cash flows may signal that your business could face problems in the nearest future.

You may think a cash flow projection is just the same as a cash flow statement. I have a cash flow statement prepared at the end of the year for my business, so what is the problem anyway? Sorry to break it to you, but they are actually two different things. Unlike a cash flow statement, a cash flow PROJECTION is used for prediction purposes. You use a cash flow projection to make estimates of the money you expect to gain or expense off in your usual course of business. It covers all sorts of income and expenses. It is a good practice if your business could produce cash flow projections that cover a 12-month period; but if you are still new to this, you can take baby steps – create weekly, monthly, or perhaps semi-annual cash flow projections. Download Cash Flow Projection here

What are the basic components of a cash flow projection? Just four major groups: Cash Receipts, Cash Payout, Cash on Hand, and Other Operating Data.

Cash Receipts

The cash inflow that contributes to your business making income. In other words, the cash you will be receiving. It is not restricted to only revenue from operations, but also includes returns and allowances, cash collections, and even interest incomes. In this section, consider the amount of cash you are receiving from loans and owners’ contributions as well. This is in total, is the amount of cash available for you to spend.

Cash Payout

Anything involving the outflow of cash, will be classified under this section. This includes monthly expenses such as your people’s wages and salaries, payment to suppliers, rent or lease, hire purchase, loan interests; as well as one-off expenses, for instance advertising, commissions and fees, repairs and maintenance, taxes. As long as it involves spending cash, you should state them in the cash flow projection.

Cash On Hand

This is the balance of cash you have after offsetting the cash payout from the cash receipts. A positive cash on hand balance is healthy for your company; but if you observe a negative figure here, you may want to start considering what payouts are necessary and what aren’t. It may be a sign that your company is facing cash flow issues.

Other Operating Data

This component represents information you need to keep track of that will help you in cash planning. It helps you have a clear view of how much you have to collect, how much you owe others, or even whether it is time for you to purchase inventories. Items under this section include sales volume (in RM/USD), accounts receivable balance, bad debt balance, inventory on hand, accounts payable balance, and also depreciation.

Since you have an idea of what a cash flow projection is, let me teach you how you could come up with a cash flow projection. It is not as complicated as you think, and it will save your business’ survival in the future!

Plotting Cash Flow Projection

Begin plotting your cash flow projection by keying in data for the first month.

1. Opening Cash on Hand

State the amount of your present cash on hand. You do not need to state the exact figure; instead, round it off to the nearest thousands (‘000) and stick to this rounding off for the rest of your cash flow projection.

2. Refer to Your Last Month Receipts and Sales Report

Obtain the receipts and Sales Report in the previous month, and observe what has happened. How much were your receipts? What was your sales amount like?

3. Key in Receipts as Estimates

Based on Step 2, try to make estimates for your current month. It needs to be relevant and justifiable. This will be used as a reference for you on how much cash inflow you should be expecting.

4. Refer to Your 3-month Expenses and Get Average Amount

Done with receipts, you shall move on to expenses. Refer to your expenses for a period of three months. You may notice some expenses might not occur every month, and this is nothing to be worried of. Calculate the average amount spent for every single item.

5. Key in Payouts as Estimates

Having the average amount would help you make an estimate for your expenses. Do not worry about accuracy. Again, it needs to be relevant and justifiable. Use your management accounts to help you in making estimations. However, if you are a start up, you need to use your common sense.

6. Observe Balance of Cash on Hand

This is a balancing figure that is automatically generated by offsetting the total amounts in Step 3 and Step 5. As a healthy company, your balance should be + (receipts > payouts). If your cash on hand is – (receipts < payouts), it indicates that you may need to start taking corrective action to replenish your cash on hand, the row named “CASH NEEDED” or you could put “Owner Contribution”. Then you need to identify what needs to be done.

7. Key in Other Operating Data

Determine what you should state in your other operating data that could help you better in decisions relating to the inflow and outflow of cash. Key the amounts in as estimations based on previous months’ records. Again based on your best knowledge, focus on the Outcome: how much you need and how long could your cash flow last?

After all seven steps above have been completed, just repeat all seven steps over again for the subsequent months. You should be able to observe a trend in your estimated cash flows, by which I ensure you, will be very useful in the future.

You are new to this whole idea of plotting a cash flow projection, and therefore you feel that creating estimations for 12 months is a very tedious process. I understand your struggle here because I felt the exact same way when I learnt about cash flow projections before I became a chartered accountant and implemented it into any business needs, not with any professional training. Hence, my advice to you is just start small and practice. Start by doing a cash flow projection for a quarter first. Then, gradually increase your number of months until you get a hang of it.

Maybe your next struggle is that you do not know to do estimates. As a beginner, it is a good practice for you to just use last month’s figure available or the nearest management accounts you have as a guide. Trust me, your brain will eventually work wonders and you will find a way. Do not place too much emphasis on whether the figure will be accurate or will be exactly the same or not. If you existingly have a sales projection, I recommend you to link it to the cash flow projection every month. This will make your cash flow projection even better as your cash received estimations would be more accurate. The items the receipts and payout components in the cash flow projection are very flexible, so you can always just add items where you feel necessary and impactful to your projection.

Kenny was once like you. He had his doubts on the idea of having a cash flow projection to help the business, but he still obeyed the CFO’s guide. With available information, Kenny plotted a 12-month projection and he was shocked to see that he actually required so much money to keep his business going. With this being determined, the CFO helped Kenny with a debt restructuring process and knowing what unnecessary costs and expenses to chop off. Kenny’s cash inflows and outflows are much clearer and outlined in order now. Kenny did not stop there; up until today, Kenny still uses the cash flow projection template to manage his business. His accounts clerk would help him create a 12-month projection, which will be revised by Kenny every three months to ensure there is sufficient cash for his business.